It is a special market, the conditions under which services are rented can be as important as the price. it means for labor market, non pecuniary factors are important, such as :

- work environment

- personality of manager

- perception of fair treatment

- flexibility of working house

Nonetheless, it is still a market

- institutions such as employment agencies facilitate contact between buyers and sellers of labor resources

- info about price and quality is exchanged

- formal and informal contracts exists, regulating time and compensation

Positive economic model

- theory of behavior whereby people respond positively to benefits and negatively to costs

Scarcity - we have to make trade offs

Rationality - utility max

(correct vs incorrect)

Normative economic model

- based on some underlying values, what ought to exist

min wage, immigration, welfare program

(good vs bad)

culture is a system of values and norms

values are abstract ideas about what a group believes to be good, right, desirable

norms are social rules and guidelines that prescribe appropriate behavior in situations

two types of transactions

- voluntary , mutually beneficial

- mandatory, based on policy or law, even though one or more parties might lose out, eg. tax

five types of market failure

- ignorance

- transaction barriers

- externalities

- public goods, free rider problem

- price distortion, eg. min wage

gov intervention can correct market failures, such as intervene to promote socially beneficial transactions

Efficiency vs equity

- What is efficient is not necessarily equity. Normative econ stress efficiency, because it can be analysed scientifically. For equity, seek guidance from political systems, not market.

Labor Market Overview

A market with buyers and sellers

Labor force and employment

unemployment rate = number of ppl unemployment /number of ppl in labor force

Wage, earnings, compensation and income

wage rate * unit of time = earnings

earnings + employment benefits (in-kind or deferred) = total compensation

- payment in kind: employer provided health care or insurance

- deferred: social security

total compensation + unearned income (interest, dividend) = income

How it works

two effects

- scale effect: wage ↑, price ↑, product demand ↓ -> employment ↓

- substitution effect: wage ↑, capital intensive production ↑ -> emp ↓

(substitute labor and machine, product market stays the same)

other effects

- demand for product ↑ -> hire more labor

higher demand at any price -> demand for labor ↑

- supply of capital, when capital price ↓

a. scale effect dominates

- more machine -> hire more workers to run the machine -> higher labor demand

b, substitute effect dominates

- same product demands -> substitute labor with machines

Thus, no clear prediction from econ theory

Supply of Labor

- market supply

if salary in other professions remain the same, more people want to become lawyers if lawyer's wages rise

if wage of insurance up, supply of paralegals comes down

- supply to firms

individual firms are wage takers - pay market wage

Wage determination

market clearing wage

w1 -> demand ↑ S ↓

w2 -> demand ↓ S ↑

market clearing wage - wage which supply = demand. at We, everyone is satisfied

The market clearing wage becomes going wage in the market.

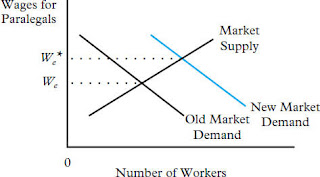

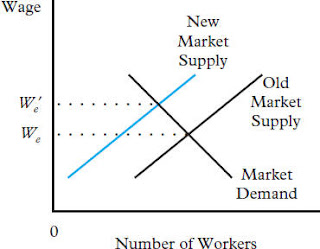

disturbing the equilibrium

- demand shift

eg. if there is new regulation, more lawyers need

- supply shift

workers decrease, market wage goes up

barriers to adjustment

- workers: skill change, cost of moving

- employers: search and training cost, firing cost, wage cost

- non market forces: law constraining individual

customs, culture

barrier of adjustment is the reason of unemployment

Discussion

market adjust more quickly for rising wages, because forces keep wages above market

market adjust slowly to decreasing wages, because labor union may protest

- the above market wages implies S of labor greater than D of labor, there will be unemployment

Applications of the theory

company overpay with above mkt wages

- if lower wages (lower than We), less ppl want to work

at individual level, economic rent is the amount where one's wage exceeds one's reservation wage

- reservation wage is the wage below which worker would not want to work

for L0 workers, they receive economic rent of W2 - W0

- employer do not know the reservation wage , so they pay more

- hard to know the fair wage